Starting with very limited remote working capabilities at the start of the COVID-19 pandemic, we transformed our technology and working practices to enable us to continue to provide a full service to our clients.

COVID-19 response: At a glance

At the beginning of the COVID-19 lockdown, we responded rapidly to enable remote working, vastly reducing the number of colleagues on site and reinventing the working days of over 600 colleagues, including over 200 of our customer service colleagues. This ensured that we were able to continue to provide vitally important access to funding for our clients during this crucial time.

How we did it: Driving transformational change

We implemented a number of new technical solutions and process changes to move to digital and remote working. Due to the complex and sensitive nature of the financial sector, this required an extremely high degree of internal governance, so we could make changes rapidly whilst staying compliant with the necessarily stringent regulatory requirements imposed on our services.

A dedicated COVID task force and executive committee quickly identified key areas of focus for an effective response: wholescale transformation to enable remote working; adjusting ways of working to ensure operational effectiveness; supporting colleagues to protect their wellbeing; and collaborating effectively with the wider business.

Maintaining highly visible leadership throughout the crisis, Phil Grand, our Managing Director provided daily status updates to all Clients, informing them how the business was implementing changes to its ways of working.

Throughout our response, we kept absolute focus on ensuring that whatever we implemented did not affect our control environment.

Lifeline for customers during the pandemic

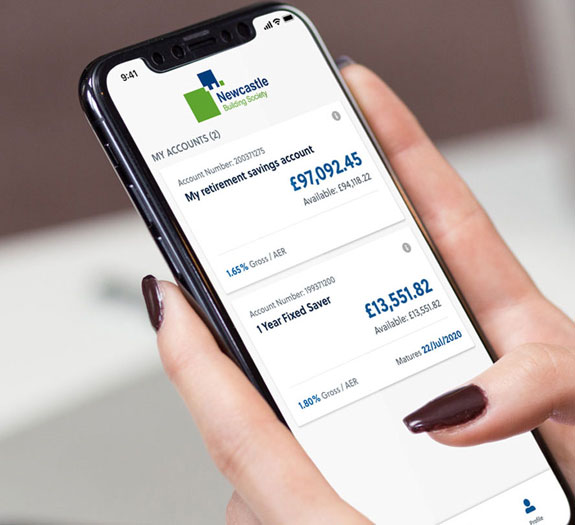

We supported our clients by continuing to operate a full service and by maintaining their customer service offering across multiple channels including online, telephone and post.

For customers, the continuity of services was a vital lifeline, ensuring that they were able to continue to have access to and management of their savings accounts. During this time, we opened record levels of new accounts and successfully managed unprecedented levels of customer activity:

With a business response that went far beyond ensuring continuity, we were not only able to deal with unprecedented volumes of customer contact but were able to maintain our focus on innovation, by securing the launch of new ISA products and the development of a Mobile App for our clients too. We were delighted when our efforts were recognised at the 2020 North East Contact Centre of the Year Awards where we won the award for Business Continuity and Innovation.